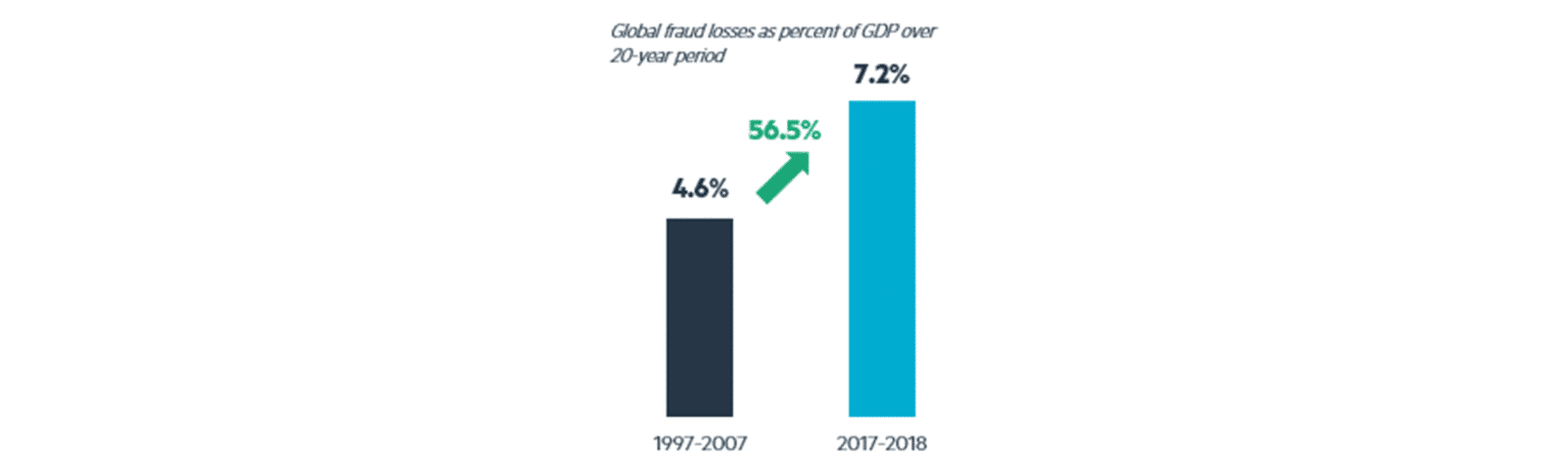

Fraud and economic crimes have been on an uptick, since 2009, loses owning to fraud have risen by 56.5% (from 4.6% to 7.2%) globally, growing a rate higher than the GDP of the most countries. The UK remains Europe’s centre for fraudulent activity with Google trends showing “fraud related searches” (covering customer fraud, cyber-crime and asset misappropriation) to be 4x those in France and 11x those in Germany.

Financial Cost of Fraud

In the context of card payments alone, fraudsters have been able to skim up to 0.4% of revenue in Europe (and multiple of that figure in US) with impact on margins 8x stronger based on typical economics of an S&P 1500 company. To put this in context, we typically find that enterprise cross-/up-sell initiatives can expect to gain anywhere from 2-5% of extra bottom line. Therefore opportunities are abound when it comes to tackling fraud.

These problems are not new, financial fraud has been prominent since the early days of trade. The first recorded incident of financial fraud was recorded in 300BC. A Greek merchant named Hegestratos took out a loan against his boat and the cargo he was expecting on it. His plan was to sink his empty boat, keep the loan, and sell the cargo. Fraudsters like Hegestratos still have the upper hand against organizations. And in today’s digitized economies, the methods have only proliferated to include include identity theft, phishing, credit card fraud, card skimming, pyramid schemes, among others. However – the play is still the same – one entity takes money or other assets from another entity through deception or criminal activity.

Fraud is evolving at a rapid pace and the challenges inherent to fraud prevention can quickly make most of the solutions developed in the market inefficient.

Fraud losses accumulate rapidly within the first 1-3 hours of first fraudulent transaction as thieves quickly max out credit prior to detection. However, the average response time is several days. Significant fraud capture relies on solutions to be rapid in their identification and response as a loss of time directly results in a loss of money.

Fraud problems are uniquely complicated and individual businesses face an individual set of problems.

The plug-and-play solutions designed to counter them are homogeneous. Organizations tend to adapt a business process to fit the plug and play solution they use rather than build a tool to solve their business needs.

Fraudsters are leveraging advances in technology, while companies are not adapting and are often reactive.

As fraudsters constantly adapt their techniques and focus, most solutions quickly become redundant at solving the problem at hand. To effectively take on fraud, financial organizations require capabilities that evolve with the times and that are flexible enough to take on the ever-changing terrain of fraud.

Our experience shows that the single greatest opportunity available to organizations today is to maximize the value of the existing data assets. Significant multiplying effects are achieved when combined with advanced analytics (AA) and artificial intelligence (AI). It also happens to be the lever with the quickest time-to-value. Set up the right KPIs and you will be able to track impact of the actions almost immediately – as the value capture in most instances is fully controlled by the internal operations and fraud teams. So what’s stopping organizations from making the most of this opportunity?

Decision makers are simply unaware of the scale of the incremental opportunity and therefore the cost of their inaction. Prior to making a decision on where and how much to invest their scarce resources, even the firms with relatively mature analytics and AI department rarely perform a size-of-prize analysis using tests on historical data. Instead, priority initiatives are selected using benchmarks or gut-feel value estimations, which at best provide a skewed perspective around where the gains can be found. Meanwhile the opportunity cost of the time and effort lost to fraud is there for the takers.

We believe that there are three types of organizations who stand to enjoy significant benefits from modernizing their fraud operations. This perspective is based on the observation that the key to unlocking value is the release of “dusty data assets” – i.e. data which is available but unused. This circumstance identifies three unique cases based on the scale and level of existing solutions in an organization:

Types of Organizations Impacted by Fraud

Firstly, there are “the under-served”; those who the market still ignores in the context of availability of plug and play solutions owing to the uniqueness of the problems they face. For the under-served, current solutions cannot address their holistic needs and current providers are not interested in building out full solutions as the addressable market is not large enough for them to scale.

Secondly, there are “the un-integrated”; those who have modern solutions that are not fully integrated within their ecosystem. This typically manifests itself as a shortcoming in either process integration leading to classic operational pain points, or as a shortcoming in data integration leading to data assets sitting unused and therefore subpar decision making.

Lastly, there are “the traditional”; those who have not adopted modern solutions to tackle the problems posed by 21st century fraudsters. They tend to be more reluctant to modernize either because they are facing more pressing challenges or because solutions have not yet achieved the price point to enable them to take the leap.

At Ekimetrics we have worked with several firms of the type described above on fraud detection and fraud prevention mechanisms powered by advanced data analytics. We have looked at the unique fraud challenges these firms face. To unlock savings and refocus the organizations on key areas that matter to performance, we balance business acumen, data strategy, and advanced analytics including artificial intelligence. Some of our recent experiences in helping companies transform their capabilities are briefly reviewed below:

Integrated fraud investigation platform reducing time-on-task by ~90%.

The operations team for a European debt recovery client was facing hours of review time for each case file that came across their desk. They knew that some of the most opportunistic areas for recovery were due build up of debt stemming from fraudulent activities – but search for these (and other modalities) was a needle in a haystack operation with the team having to navigate and integrate information across a web of sites. Over several design-thinking iterations with client, Ekimetrics ultimately focused on developing a custom module for case investigation. The module sources and integrates external data into a single internal workspace and pre-links potential connections across clients, businesses, assets, and other key dimensions, reducing case review time from an average of hours to minutes, and making a step-change to the cost-structure of the business model for significant performance gains.

Streamlined fraud operations via Digital Footprint Analysis for ~25% operational savings

Powerful solutions typically solve several problems at once. And in the context of operations, including fraud, in which an ecosystem typically involves several roles and processing steps e.g. from alert to escalation to review to sales representative to confirmation to action, different forms of inefficiency can creep in over time. At Ekimetrics, we use Digital Footprint Analysis to pinpoint hidden sources of operational pain, and develop custom solutions to break down bottlenecks for maximum impact. In processes, inefficiencies creep in in one of three ways – inefficient queues, lengthy time-on-task, and slow hand-offs – all contributing to the overall speed of response. Therefore it becomes critical to review each of the inefficiencies – and with an abundance of data captured by modern applications, optimizing all at once does indeed lead to out-sized savings.

Migration to an AI-based fraud solutions on path to ~40% fraud loss savings.

The fraud team for a European client was under pressure of high fraud credit losses eating into thin margins. They were also bending under the technical debt of an ever-growing set of rules designed to fight fraud. Following the initial flash diagnosis, Ekimetrics identified “risk scoring through AI” as the key lever to take the fraud function to the next level of performance – owing to the ability of AI to synthesize and N-dimensional signals (limited only by availability of data) and to adapt to fresh market conditions over time (via periodic retraining). Furthermore, rather than reaching for the benchmarks, Ekimetrics prototyped an AI scoring model, which put a specific dollar figure on the value of “dusty” fraud data and pinpointed dimensions of greatest value to fraud risk valuation. This spurred immediate action and helped accelerate industrialization of a risk scoring solution on path to ~40% direct fraud savings.

In conclusion, organizations of all sizes can achieve significant savings and positive ROI today via targeted investments. The benefits from implementing fraud solutions can be quantified ahead of deep technology integration, which makes the decisions easy and virtually guarantees a positive ROI owing to foresight. Adapting solutions to the organization, instead of organizations adapting to a solution, minimizes the scale of disruption and increase the odds of success.

—

> Subscribe to the data science & AI newsletter!