Connected data has grown rapidly across many industries and operations in recent years. The increased availability of data represents a potential gold mine – untapped potential in better understanding of the overall operations of a business, and consequently allowing brighter strategic decisions. Several topics have emerged surrounding how to best leverage these data streams, including discussions over predictive maintenance and predictive marketing. However, very few businesses are able to capitalize on these new sources of information, as much of their data is underused due to two critical limitations:

.

An insufficient capacity to store and analyze terabytes of data, continuously arriving through thousands of sensors, is overwhelming. Handling it all is challenging enough, let alone translating it into actionable business outcomes.

A lack of skills and resources to bring data to life in a scalable way. Auto manufacturers have a wide range of opportunities to leverage and industrialize connected car data for use cases such as better cash-flow generation. Whether it be improving individual customer journeys, personalized targeting, predictive maintenance or the leveraging of new communications channels (like mobile apps and car dashboards), each opportunity requires substantial investment in skills and infrastructure to extract value from the data.

From collecting raw data to designing personalized marketing communication, this article provides concrete examples of business case industrialization led by Ekimetrics in the automotive industry using the connected data of a leading car manufacturer.

By 2030, about 95 percent of new vehicles sold globally will be connected, up from around 50 percent today. This scale will generate petabytes of data throughout the customer journey. New use cases will appear across many levels of the business, particularly in the sales and aftersales departments.

Due to its nature, the aftersales market is already highly lucrative, with competition fierce between automakers’ aftersales workshops, independent car dealerships and online parts vendors (Amazon, eBay motors, Midas etc.). However, with the growth of connected cars, a paradigm shift is underway and is beginning to favor the owners of the data: manufacturers. The value associated with streaming data from thousands of sensors within these connected vehicles is currently owned exclusively by manufacturers. Providing them with a competitive advantage that can be used to boost drivers’ loyalty towards the brand, both in terms of their choice of aftersales support, but also the purchase of their next vehicle.

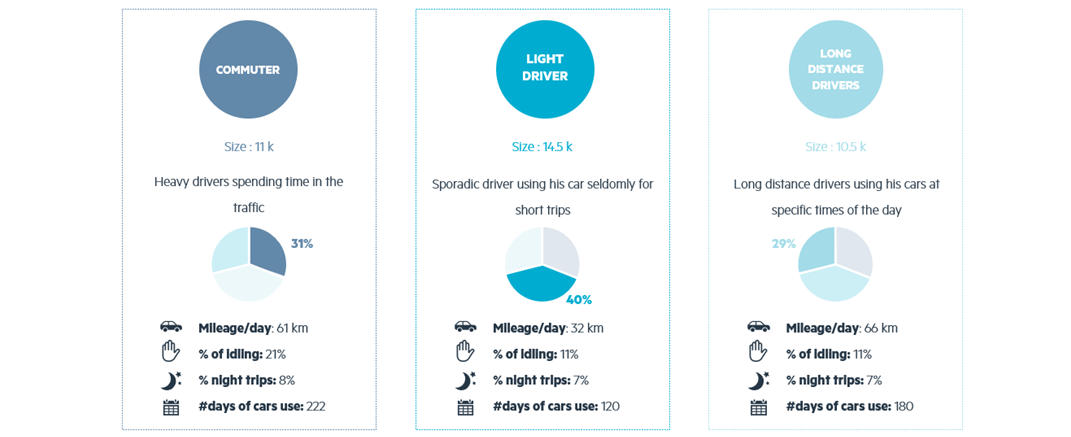

Connected data also helps to better manage and maintain the condition of vehicles, through anticipation of breakdowns and part failures, but also by distinguishing driver profiles in order to better adapt marketing communications.

Connected car data currently allows the manufacturer to obtain information regarding:

Driver habits (from driving style to the frequency of car use)

The state of each car component (battery, air conditioning etc.)

GPS data, to understand what kind of environment the car is mostly being driven in

Climatic conditions (use of wipers, use of air conditioning etc.)

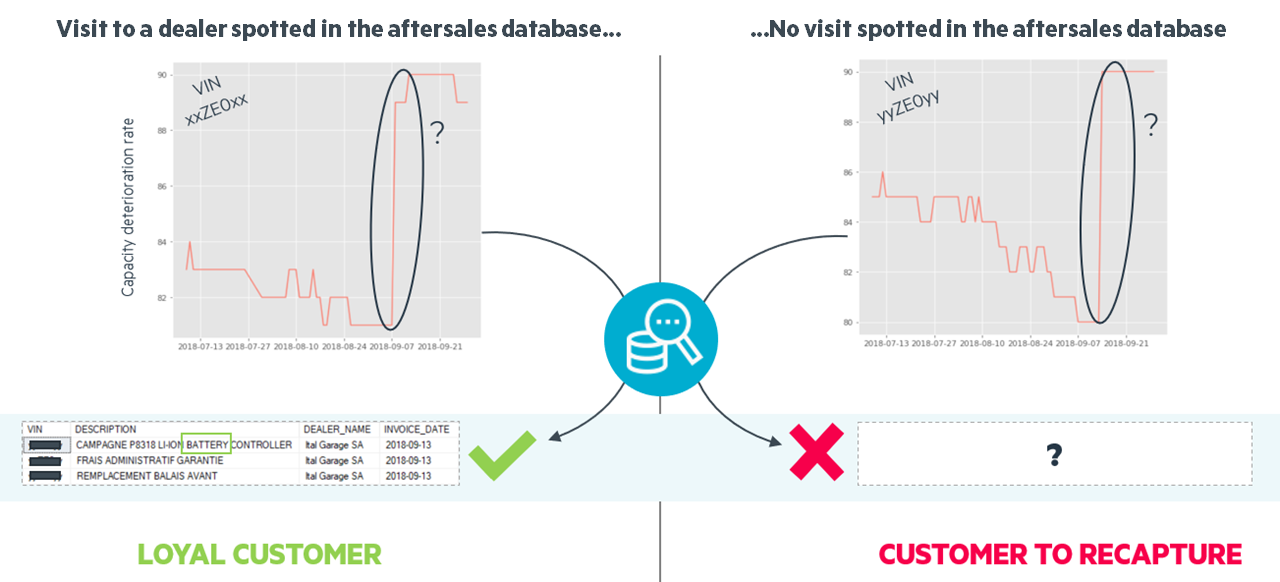

Aftersales operations made outside of the brand dealer network (identifying customers who churned)

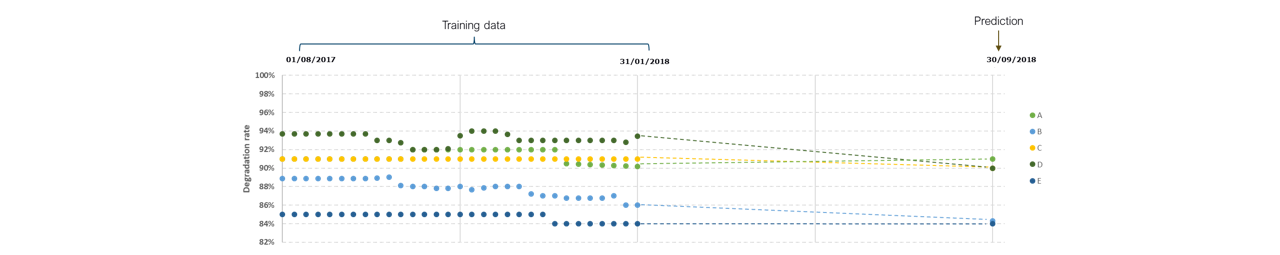

Level of wear for tires, brake pads and other key components, based on driving habits and sensors

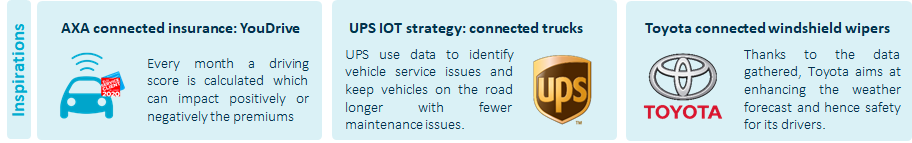

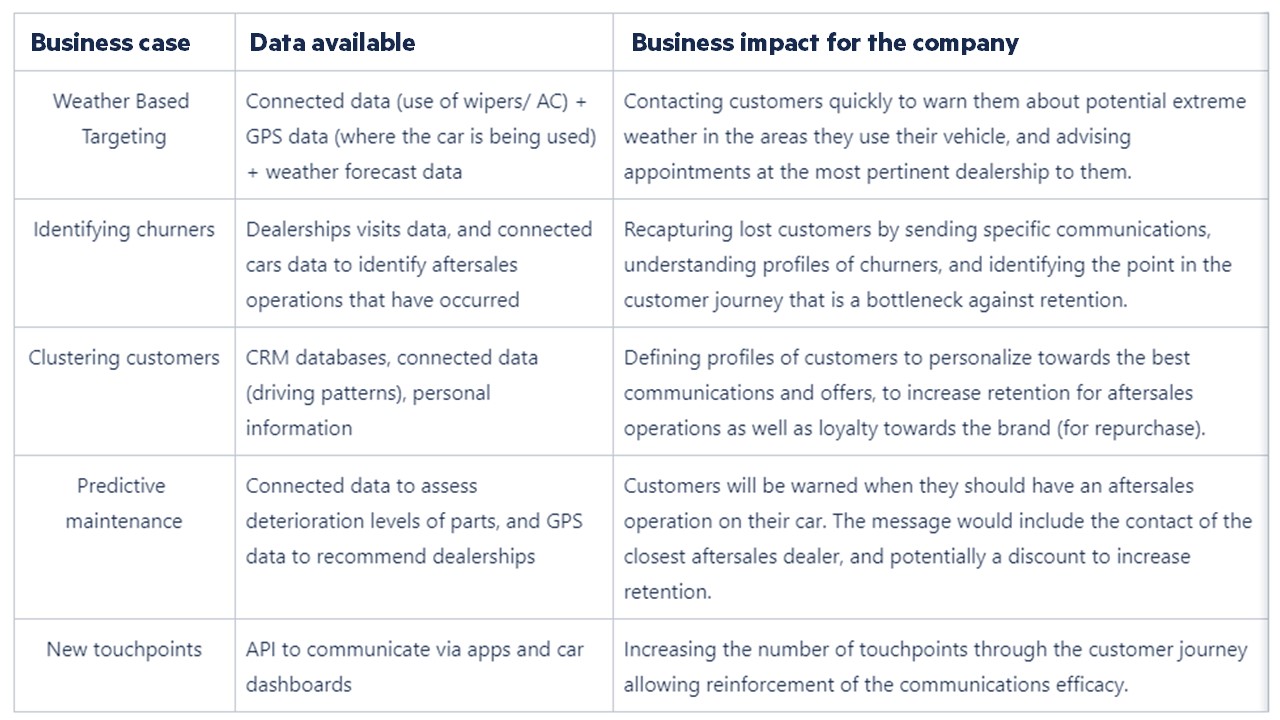

With this data now available, related business cases have begun to flourish, each with the intention of boosting brand salience and retention.

Marketing teams now have a way to generate greater traffic at their aftersales dealerships, through more effective communications (contents and timing) and precise recommendations that pinpoint the customer’s closest and most relevant dealership.

Insurance teams can use it to adapt policies based on usage by the driver adapting the price of premiums, warranty extensions and provide driving tips).

Sales teams can recommend the best model customization, given the customer’s driving style, journeys and specific vehicle needs.

.

Given the above opportunities, data science teams should also be connected and in a continuous discussion with all other “business teams” in order to bring data to the forefront of decision making.

Data is already a part of the equation in today’s Customer Relationship Management operations. Having access to data like the vehicle purchase date or the date of last dealership visit has historically allowed brands to anticipate customer needs. They can then communicate discount offers on aftersales visits or target test drive offers to encourage repurchases. However, these actions are performed using static data which limits the effectiveness of communication. The lack of dynamic personalization in content, offers and timing will only go so far in bringing brands closer to the customer’s needs.

As data becomes more expansive (from terabytes to petabytes) and diverse, companies struggle to take the opportunity. This leaves heritage brands in a critical problem, given disruptors in the automotive industry are entering the market and taking share with their firm grasp of data science thanks to their endemic use of cutting edge technology and analytics.

Newcomers in the automotive industry include naturally names like Tesla. Beyond this though, and less obvious, Google car manufacturers and online retailers such as Amazon and Ebay Motors, as well as pure players like Oscaro and Midas, are all competing for this online purchase of aftersales parts. In this context, mainstream car manufacturers and their associated workshops are on the back foot, with these competitors have an advantage through years of mastering data analysis. Tesla for example was able to remotely extend their cars‘ battery capacity (more about it here). Meanwhile, in a series of projects led by Ekimetrics for an aftersales pure player, we were able to leverage their maturity in data management to track visits and recommend products to consumers.

In addition to improving the link between analytics and operations, brands must also grapple with new communication channels. Emerging channels remain underutilized by mainstream manufacturers, who are comfortable using traditional tactics such as postal mails and emails to engage consumers. New touchpoints such as apps and car dashboards, should be leveraged jointly with connected device analysis to efficiently communicate with customers in new environments, performing bespoke tests on the channels before scaling.

In order to help businesses address the challenges of connected data, Ekimetrics understand we need to handle and analyze data from multiple sources. An array of data-feeds are necessary to build an exhaustive overview of customer journeys, but requires working with terabytes of data received at a constant rate. Thanks to cloud infrastructures and new data lake technologies (such as the Apache “delta lake”), we were able to successfully industrialize a data pipeline when working with a leading automotive brand.

Data sources included:

Connected car data from tens of thousands of actively used cars

Visits at thousands of dealerships across Europe (sales operations and aftersales)

Customer databases with personal information (addresses, contact details, start date of car ownership etc.)

Which allowed us to build the following use-cases:

.

On top of the value purely from data analysis and forecasting/segmentation models, we also work closely with our clients’ marketing teams, designers and web developers to align modelling with decisionmaking.

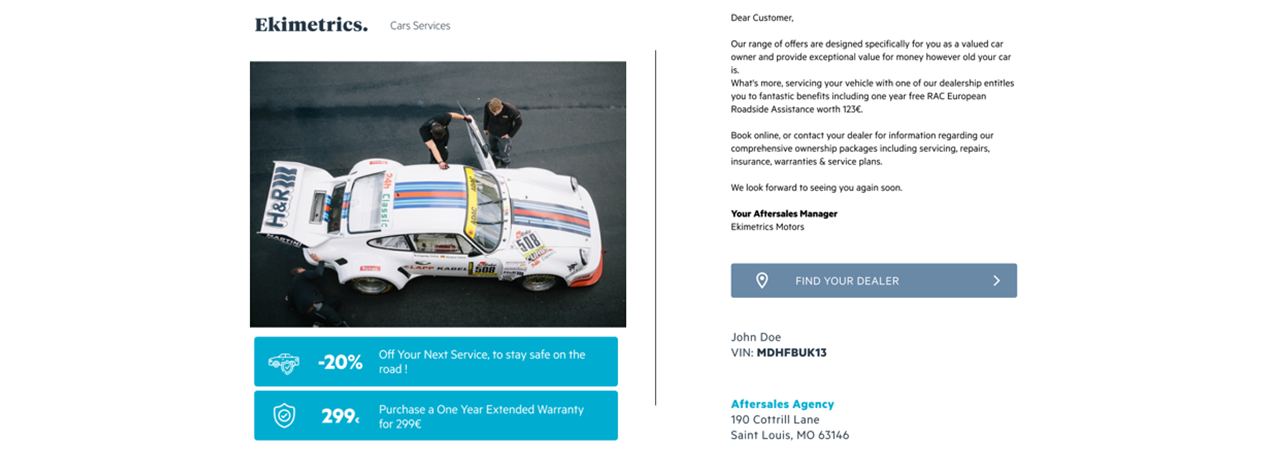

From our analysis, we developed a set of highly personalized communications, both terms of the content shown but also trigger timings delivered through new touchpoints (downloadable apps and car dashboards). These communications indicate the closest dealers, adjust the discount level according to the drivers’ profiles and provide extra services and driving tips linked to activity on the road.

.

Connected car data can provide a decisive competitive advantage to businesses that are able to efficiently store and analyze the data available to them. Brands that do not act risk being overtaken by the emergence of next-generation data-literate players. Although this untapped potential is evident in many industries the illustrated use-case of Automotives provides simple learnings on how to implement complex data processes for others to follow. Ekimetrics continues to provide support to the automotive sector with high-tech solutions, to help drive value in many business areas. Some examples of currently live use cases are listed below.

[2] https://medium.com/@mig.vassalo/the-after-sales-business-in-the-digital-era-f1d0da41f0cb