Whilst retail and telecom players kick-started digitization in order to bolster customer experience, it seems insurance companies are beginning to follow suit. Until recently, investment in the insurance sector was focused on risk management and pricing-up policies. This is insurance as we imagine it; armies of actuaries and statisticians working to achieve these end goals. On the other side, claims departments and field operatives were neglected, simply not receiving the same financial backing to support operations. Things are now beginning to change.

Settling a claim involves interactions between dozens of individuals: the insured, the general agent, the other party’s insurer, experts, partners, spare part vendors, plumbers and so on… The complexity of the process stems from the need to coordinate these numerous intermediaries, inevitably slowing things down and generating inefficiencies. And paradoxically, having more experts throw in their opinions and calculations typically doesn’t make the refund estimates more precise. You will often see significant gaps between the insurer’s estimate (characteristically at the lower end) and the reality of the insured party’s needs (the higher end), a disparity that triggers distrust in the provider from the insured individual.

An effective solution against this can be to disintermediate. One of our clients, a world leader in insurance, has chosen this approach; developing their own network of car repair shops and hospitals, as well as purchasing spare parts groups. The decision has allowed them to cut down on inefficiencies, keeping a hand on how operations are managed, while securing performance traceability (using dashboards for repair shop performance, and the induction of KPIs to monitor the average cost per type of servicing task). Our client has pushed this one step further, turning this strategic change into a perceived benefit. This disintermediation has now become a differentiating factor for the firm.

To this day, data science, machine learning and artificial intelligence are still not widely used in the field of insurance. And yet they hold the promise of short and medium-term opportunities that would provide an extra layer of intelligence, and greatly facilitate the daily tasks of operational staff. The way we see it, the biggest benefits of incorporating data science would be:

For several years two phenomena have been developing in parallel, shaking the world of insurance, forcing companies to rapidly improve their resilience, and rethink their business model for the long-term.

The emergence of startups referred to as Insurtech (a subgroup of Fintech) is the more visible phenomenon. Being digital native and obsessed with customer experience, they contribute by raising consumer expectations and putting pressure on the typically complex operations of incumbent players. Tractable, for instance, uses Image Recognition (AI) to come up with an estimate of the damage and refund required within just a few hours of a claim. Dinghy and Untangler meanwhile facilitate the search for data from within millions of correspondence items (letters, quotes, email contents etc.) by using sophisticated machine learning mechanisms. Doing so enables them to speed up and facilitate tasks that were extremely tedious and labor-intensive, overcoming a major point of pain for insurers and their clients alike. According to a study by PWC published in 2017, 56% of insurers worldwide believe that 20% of their income is threatened by these Insurtech operators (source: Fintech Mag). Possibly because of this, 45% of these leaders point out that they have now set up a partnership with an Insurtech (versus 28% in 2016). Yet while these traditional insurers are looking to quickly reposition themselves, it would seem banks are leading the way in this respect, with many already in a position and keen to work with these new startups (source: Accenture, 2017).

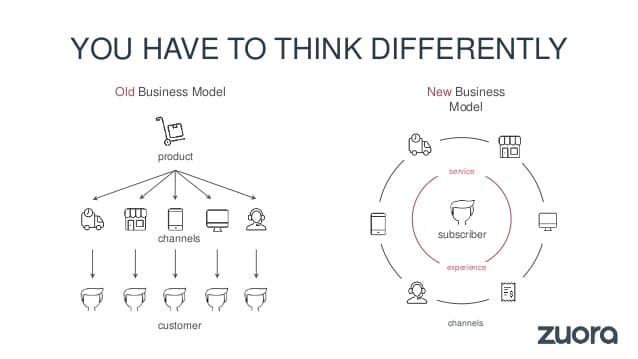

The second phenomenon relates to the emergence of smartphones in the mid-2000s. We are still within the learning curve for newer types of mobile use, however it’s already clear that mobile evolution has brought about a new culture of immediacy, fostering a growing level of consumer expectation. Access to services and content across the world “at the swipe of a thumb” has been a game changer, both in a geographical sense, by neutralizing the distance complications between countries (access to information in all languages etc.), but also through the creation of new and more disruptive channels. The smartphone sits at the crossroads for all services, capable of performing new functions (information, payment, gaming, transport, banking, etc.) and challenging the traditional need for stores and desktop devices. Mobile capability is speeding up the digitization of customer journeys, both at the front-end and the back-end; the subscription economy (subscription-based consumption) and the “service economy” are two of the most telling examples of this. The bottom line for businesses though (including those in insurance), is that access to their products and services has been totally revolutionized. The way companies and brands design their product and service-offering architecture must be rethought altogether, and the result will be a reconstruction of the very foundations of their business model.

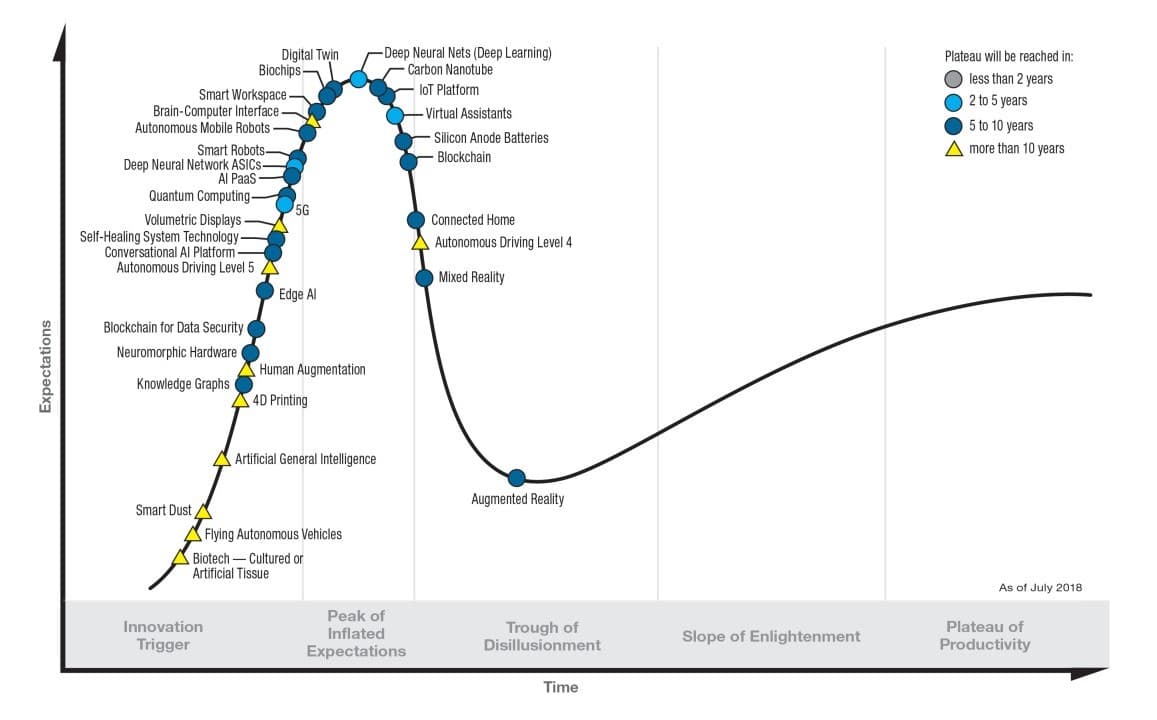

More subtly than this; digital solutions, artificial intelligence and the technological hype phenomenon are causing a restructure of the modus operandi for businesses. Many organizations rely heavily on their data maturity (senior management, teams, IT infrastructure, etc.), and wider technological offerings mean a greater disparity in analytical capabilities across firms. For the past four years different technological platforms (CRM, Data Lake, DMP, marketing automation) and algorithmic approaches (deep learning, Bayesian approaches, etc.) have aimed to solve business needs unequivocally, however many firms are emerging from this hype experiencing instead a ‘Trough of Disillusionment’. We are seeing businesses that, albeit very well equipped with technological tools, have struggled to justify the return on investment in terms of business impact. The disconnect between approach and desired results can be attributed to a number of factors: follower syndrome, a technological stack disconnected from reality, misconfigured KPIs, or even a lack of alignment between business needs and senior management decisions, etc. This phenomenon or detachment was very aptly illustrated by a Gartner study.

For a world leader in the insurance market and client of 14 years, an effective solution to the Gartner concern relies on a data strategy that aligns with their three-year core business roadmap. The roadmap itself looks to refocus on customers, optimize profitability, conquer new markets and create new data and analytics assets across the company. The senior managers must trigger momentum through a widely distributed business vision, while calibrating the correct data initiatives upstream. Doing so enables line managers to inform every department of the organization’s transformation ambitions and the relevant KPIs. It is through the power of data science and its cross-disciplinary capabilities – advanced analytics, IT and business – that these strategic initiatives can be implemented. It will serve the business challenges by bridging together strategy and operations, and instill consistency and vision to data development in the short, medium and long term.

With all of the above in mind we see great potential in three areas, all of which will launch an evolution towards data-driven decision-making processes:

As mentioned previously, the value proposition of claims management is still not sufficiently geared towards customer relationships. It should depart from its very functional “Detect and Repair” setup and favor a more proactive and caring model such as “Prevent and Predict”. A brand promise that is more in harmony with the real needs of customers will allow a company to maintain a competitive edge over a much longer time frame. Below are some examples that we’ve implemented with clients in the insurance sector:

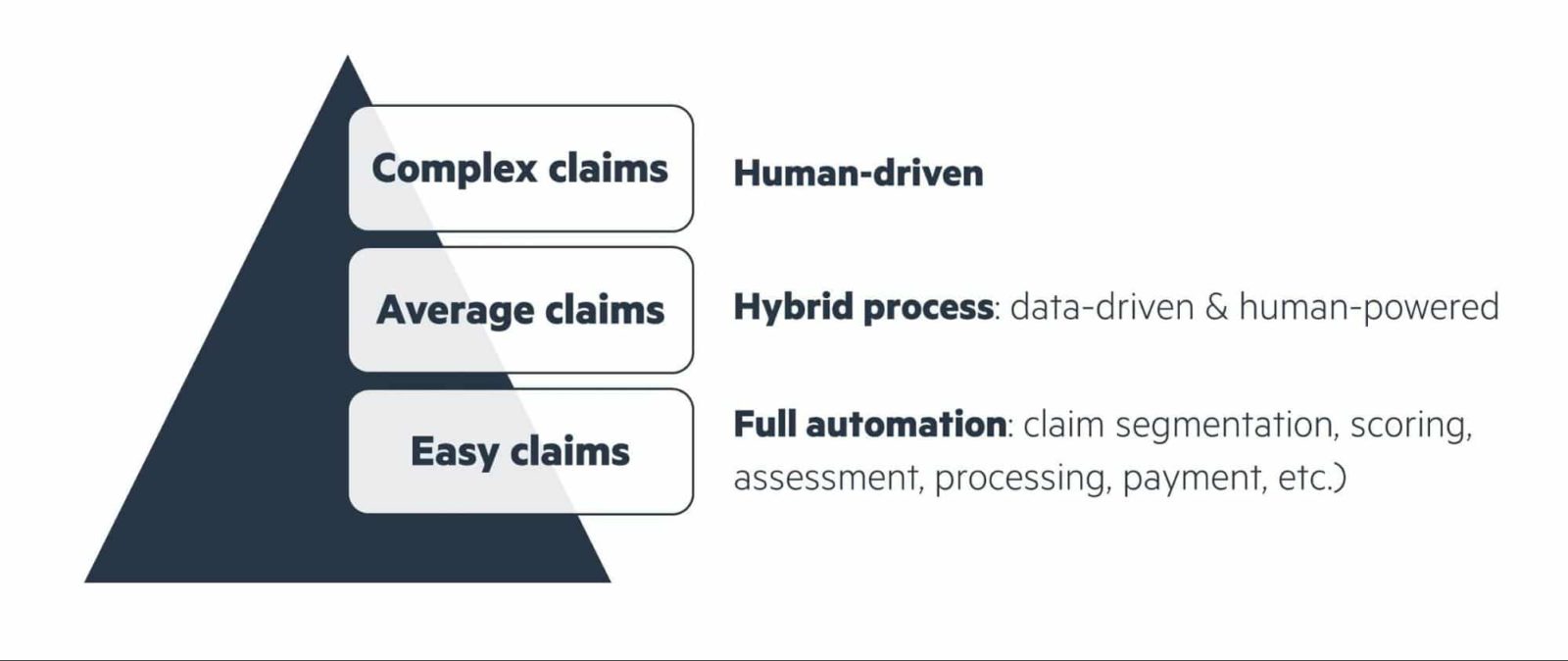

The typology of claims ranges from low-cost claims with a high occurrence to less frequent high-value claims. By digitizing the reimbursement process, important facets both for the customer (e.g. transparency) and the company can then be dovetailed, ensuring a more seamless process. The value-added modules will utilize the data, handling claims more effectively based on their frequency/severity. Despite the algorithms being extremely efficient in a mathematical sense, in the most complex of cases they are limited, and the input of business expertise here would serve to simplify the transmission further.

Below are a selection of use cases where the use of data science would offer a stronger solution, with the approach tailored based on typology of claim:

Beyond their data-driven projects, certain businesses have embarked on a more structural transformation, employing data science’s capabilities as the cornerstone of data, tech and business. Once a strategy has been precisely outlined, we work with the client to identify all data use cases that directly pertain to their business priorities: performance, operations, customer centricity, search for new markets, etc. The upside of this is that everyone from senior management down to the business lines and IT are aligned in terms of the cleanest strategy. From here, it becomes much easier to anticipate the investments required to uphold the roadmap for the next 3 to 5 years, whether this be profiling of the jobs required (data engineers, data scientists, ML Ops, IT Dept, etc.), setting up a data factory, or rescaling the technological stack. From an operational angle this yields huge benefits: it aligns the teams on a common project, promotes collective buy-in, and coordinates progression of the data roadmap efficiently.

One of our clients, a world leader of B2B, decided to place consumers at the heart of their strategy. They drastically changed their brand promise from a mere service provider into a genuine business partner. At the crossroads of several departments (Marketing, IT, Data, CRM), Ekimetrics set up real-time monitoring of customer satisfaction, deploying advanced statistical methods to reduce attrition, and created data frameworks to facilitate day-to-day handling of insights and dashboards that could then be used by business experts. Consequently, all units could then be directly linked to the customer, both upstream and downstream, coordinating their efforts in light of this shared objective. By using simple and very business-oriented data visualizations, it secured buy-in across the board leading to a hugely powerful revamp of the entire data structure.

It is also possible to instill other less direct structural transformations in order to boost business lines. We can guide and deliver on the implementation of a data lake, provide clarification on data governance, set up IT environments capable of supporting big-data projects for several departments, POC industrialization and much more. The diversity of ways in which a company can optimize performance is vast, and this is why we believe organizations should always make their business priorities the guiding light of their data transformation.

We know all of the above to be empirically true. Artificial intelligence and data science have already proven successful, and for several years they have boosted the evolution of insurance businesses globally. Whether bolstering the transformation from a low customer-interaction model to one that is more customer-centric, or by automating large segments of the “production chain”, data approaches must work to perfectly pursue the company’s strategy by creating genuine value within its business lines. Beyond the most intricate of data science considerations, there are also the human aspects that should never be overlooked. Change management and acculturation of the teams must always be accurate and thorough, to ensure that any data project deployed delivers real business impact.

—

> Subscribe to the data science & AI newsletter!