A pricing strategy which maximises profit per customer is hard to implement efficiently when companies are faced with complex pricing structures, individualized contracts, and legacy customers with prices that were locked in years ago as the pace of business changes rapidly.

Further complicating things for B2B firms is a lack of market intelligence. In a market where services provided to each customer are so tailor-made, pinning down a ‘market price’ for a product or service is near impossible. In the absence of market benchmarks, one must rely on teasing out every customer’s willingness to pay – a seemingly simple task, but challenging in reality.

Firstly, firms should question whether they truly know their customers. Consider a large portfolio of customer accounts, with each account having multiple sub-accounts and sub-sub-accounts spread out over a large team of sales representatives with little centralisation. In this situation, it is difficult to identify customers as a single entity and gather any useful information on the customer’s business. There is potential for a lack of internal data on customer identity, with self-reported customer industries and minimal data cross-validation procedures in place. This means it’s nearly impossible to categorize customers into functional segments.

Secondly, if you don’t truly know your customers, then you don’t have an optimal pricing strategy. We don’t know the customer’s willingness to pay, since this depends on the customer’s industry, the product’s share of wallet, their location, and other factors unique to every individual customer entity.

Thirdly, a radical change to strategy requires a unique action plan. With potentially thousands of clients and billions of elements of data to connect into a coherent picture, a firm needs to isolate distinct steps in reforming the entire pricing system. This should start with the quickest wins that deliver the largest gains. Driving complexity was the fact most of the contracts in the portfolio had expiry dates years away – and each year an unprofitable client was kept on meant loss.

Ekimetrics was brought in to tackle this pricing problem for the B2B arm of a leading multinational firm.

To begin, the client had three segments covering roughly 90% of their product volume. We needed something that took industry into account.

Why is it so important to consider customer industry? Depending on the nature of the customer’s business, we could then infer their usage of the product, and understand what importance they placed on the product. How much were they using it? At what point in their value chain did they need it? What percentage of their cost base was attributed to the product? Being able to answer these questions allows an understanding of a customer’s willingness to pay.

The problem was that most of the client’s data on customer identity was self-reported. This information was also spread out across different sales representatives. What they lacked was a detailed micro-segmentation of customers based on purchasing behavior and nature of business. With this in mind, Ekimetrics set out to re-segment thousands of customers.

First, we connected the client’s transactional database with a third-party data source that had textual data describing each business.

Using NLP (Natural Language Processing), we turn the unstructured information into a 300-dimensional vector characterizing every single customer’s business activities. Then, similar ones are group homogenously using clustering techniques.

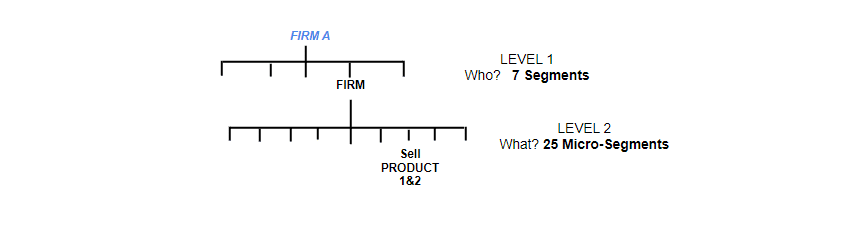

Much of this textual data was the same, so the segmentation was conducted on two levels; one as an high-level description of the business (i.e. wholesale, retail, company, firm), and another to describe the granular nature of the products or services they were producing, transporting, or selling. From this we were able to iteratively derive a micro-segmentation of customers based on their business activities.

Using this method, we arrived at 7 segments and more than 25 micro-segments of customers. Compared to the starting point of 3 segments, this process significantly increased the capacity to understand customers at scale.

With these micro-segments we can then begin to arrive at a proxy for a customer’s willingness to pay. But first we have to ask, what is the customer currently paying?

Seemingly an easy question. However, the client had a very complex pricing structure consisting of a base benchmark, layers of additional fees, layers of discounting, and annual kickbacks and rebates – all of which are liable to move regularly. The consequence of that structure is that it makes it nearly impossible to compare customers on a like-for-like basis. So the first step was to derive a current price for what the customer is paying. We did this by individually re-indexing billions of transactions against a chosen daily price point, to give a common base to compare every contract against.

One would expect to see that as a customer’s volume usage of the product increased, they would be eligible for more discounts to incentivise loyalty. However, what re-indexing revealed was a large spread of customers across all areas of the volume-price axes, with no clear pricing logic. There was also a clear group of customers who were contributing purely negative margins to the client.

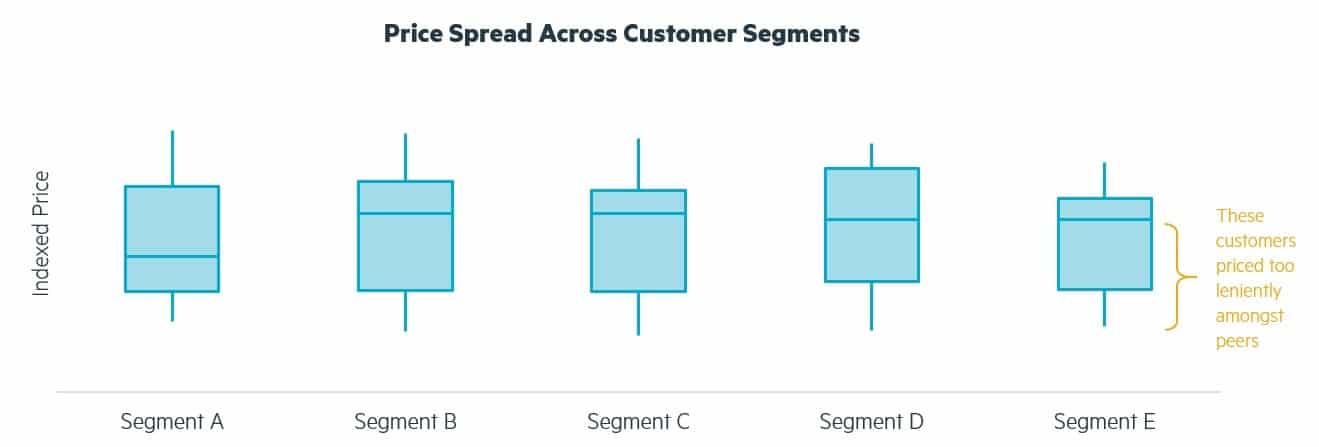

After arriving at this indexed price, we turned to look at price spread within the micro-segments we identified. What became apparent was:

1 | Newly acquired accounts were spread all over; there was no benchmark for anchoring a new lead’s contract to look-a-like existing customers. Rather, the newest accounts tended to be in the lower two quartiles of that segment’s price spread.

2 | Three clusters emerged as providing the largest ‘quick wins’. Assuming successful negotiations of customers below the 1st quartile to the current median price, three segments of customers represented the largest size-of-prize gains.

Now that the client knows their customers and knows who to target, how do they go about it?

Unlike in a B2C context, the client can’t unilaterally change the price of the product – each contract is a negotiated relationship with a customer. Further complicating things was that most of the contracts were evergreen, and there is no way to know what the competition is pricing.

Here’s what we proposed, starting from the quickest wins to the most long-term strategy changes:

1 | Drop the unprofitables. There was a good chunk of customers who were purely making a loss for the company. There was no pattern as to this cluster’s size, industry, or geographic location; they were simply a group of customers who had managed to negotiate a very hefty discount. These drove a pure loss for the client but were previously unidentifiable as unprofitable due to the complex price structure. Once we switched to an indexed price comparison, it became clear that simply terminating the contracts at the end of the contracted year meant a 1% increase in generated profits.

2 | Start using the micro-segmentation with current leads. Before we get into looking at existing contracts, the easiest way to influence pricing strategy reform is to apply the new thinking to current leads. This is achieved by assigning the lead to its respective segment and identifying its peers’ willingness to pay. Using its peers as anchors can then give direction for how to start contract negotiations.

3 | For existing under-performing contracts, start renegotiations by targeting those with least bargaining power first. Those priced at lower than the 1st quartile of their segment would be faced with the renegotiation of the contract through the sales representative. Who are the ones with the least bargaining power? These are the customers who, due to various factors identified during the segmentation process, we had good reason to believe would not be able to sign a contract elsewhere.

What became glaringly obvious to us and the client throughout this partnership was that the most important part of a B2B pricing strategy was knowing your customers.

Let’s break it down – what does it mean to know your customers?

You have to know what the nature of their business is. Customer segmentation is just as important in B2B as it is in B2C; when you know your customer’s industry, you can find its peers. It’s a relatively easy-to-access data point that gives you a rough signpost as to where your new lead fits relative to the others in your portfolio.

You have to know a breakdown of their cost base. This comes from our micro-segmentation – drilling down into the details of what sub-sectors an industry is made of gives you a clue as to how much your customer values your product, and at what part of their value chain. This provides opportunity to compare look-a-like customers, giving sales representatives more information to be able to tease out a customer’s willingness to pay in a market that lacks transparency by design. Take a look at your own understanding of your customers and think about whether you really know them as well as you could do.

These programmes require the ability to handle large volumes of data, reconcile different data source and mixed data types, merging third party data, and manage the system architecture needed to make this live.

—

> Subscribe to the data science & AI newsletter!