Sophie Desroseaux, Paul Seguineau and Quentin Michard, experts from Ekimetrics, discuss their vision on the future of the automotive industry.

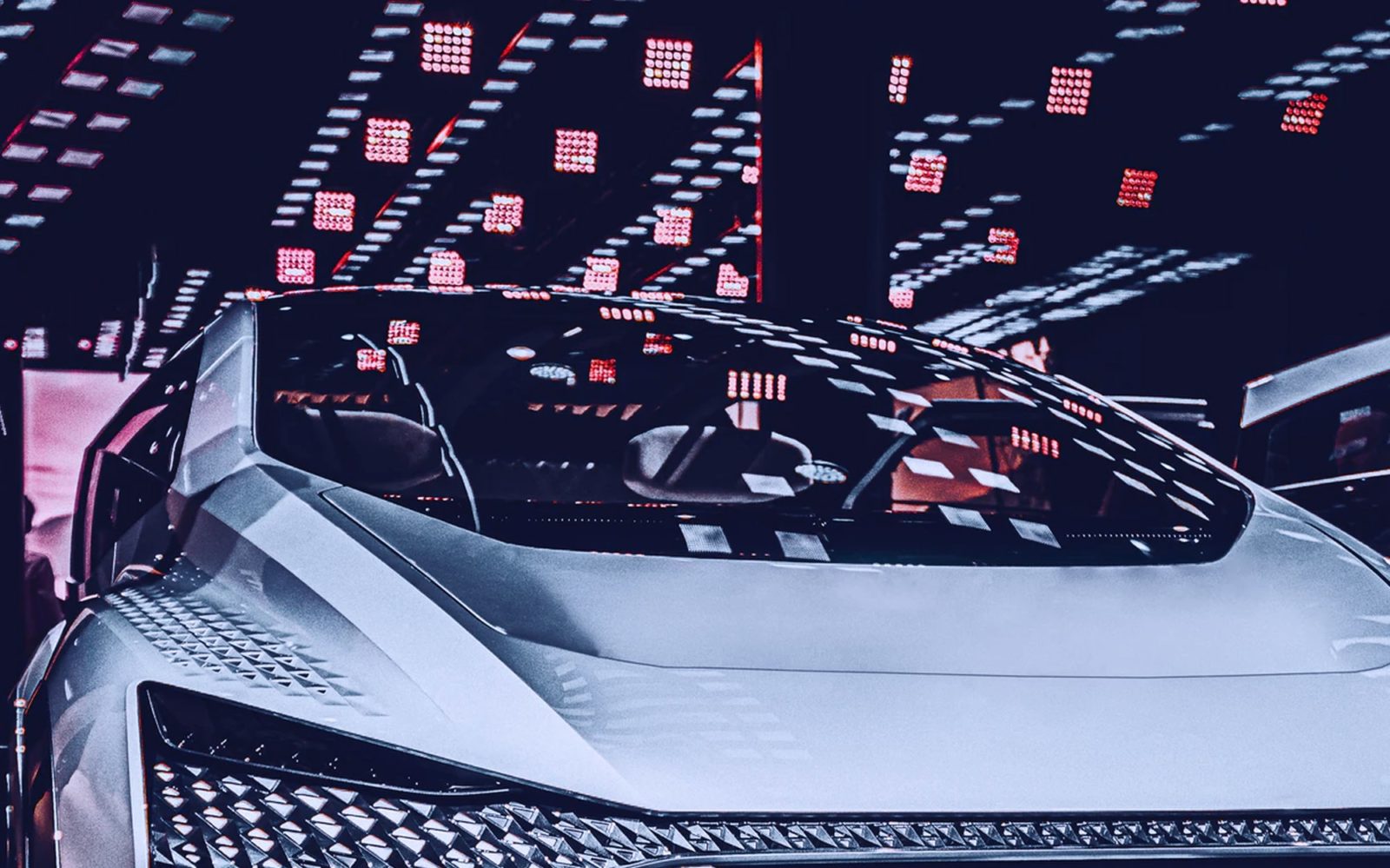

The automotive industry is a very competitive sector which has always been driven by product-focused development strategies. The development of a strong innovation culture is required for this complex business sector, to continuously develop new products & technologies. The objective? To stay ahead of the game. The solution? Offering wifi in vehicles, using mobile phones to lock cars, developing hi-tech driver assistance systems & adding increased connectivity.

The automotive sector has not escaped the digital revolution. From the production line, to the customer journey, to the vehicles themselves. The key success factors for manufacturers today are to adjust their product range & business models along with organisational and technological capacities. As recently observed in retail & in manufacturing sectors, today marketing is at a pivotal point for the automotive industry, involving the transition from a totally-product centred strategy to a much more customer-centric strategy (this is particularly the case in after-sales). A promising opening, whilst a tricky manoeuvre to pull off, as the challenge lies in knowing where to invest resources.

In the 2010s, the driving experience was key for consumer expectations (test-driving the vehicle before purchasing). From now on, technologies and digital opportunities have been adapting the expectations & the customer experience has dramatically changed. From driving pleasure in the past, to the range of services. Connectivity, driver recognition, personalisation, etc. are becoming increasingly important and reshaping the sector. Particularly, the experience inside de vehicle has become a key standard in the purchasing decision, a totally new & unexpected phenomenon.

The customer journey has also been disrupted: 21% of customers no longer test-drive cars at the dealership. A TNS/Google survey revealed that buyers of new vehicles are now performing only 1.1 test drives (1.3 in 2016 & 2.6 in 2010). Why such an evolution? Traditionnaly, car dealerships have been the only ones to own information about their vehicles (price, colours, options, rankings, etc). With the internet, everyone can have now access to everything. Moreover, online configuration tools are able to take care of most of the searching & personalisation work. Easily accessible on the web, test-drives & owner reviews help accelerate the process. A change that clearly reduces the importance of car dealerships in the purchasing funnel, to such an extent that e-commerce, which was previously the preserve of the second-hand car market, is being seen by some leaders in the sector as an increasingly serious alternative… This bold move would enable them to collect owners’ data as well as bypass the traditional manufacturer-customer-dealership relationship & to re-establish a direct link with customers. However, the short-term reality is more nuanced. Car dealerships remain strong points of contact in the after-sales period, so that they can be considered as vital collection points for data (on servicing, frequency of visits, vehicle maintenance, etc.) for vehicle manufacturers.

This access to information is not one-sided & companies are also profiting. Consumers have now a voice on social networks. A great opportunity for car manufacturers to streamline their product portfolio, to adjust their services according to customer feedback & position themselves at crossroads which really matter in the customer journey. This means a new deal in the manufacturer-customer relationship, helping companies to identify niche opportunities while, in theory, ensuring consumers benefit from more targeted products. This heralds an era of transparency, with a new, more holistic approach to communications & repositioning value-creation at the heart of the dialogue between manufacturers & customers.

In the automotive sector, the game isn’t over with the conclusion of a sale! Traidtionally, 4 critical periods are identified, each of them requiring its own relationship approach:- prospecting- purchase of the vehicle- delivery- after-salesThis cycle begins again with a re-purchase, ideally… Thus, this is crucial in the automotive sector to exploit opportunities for contact with the customer once the vehicle has been sold, especially since it has been proved there is a real correlation between after-sales relations, re-prurchase & loyalty.

In a context of fierce competition, there is increasingly sophisticated CRM practices in automotive, illustrating manufacturers’ desire to invest more in digital, thanks to more structured & sophisticated loyalty strategies.

What’s more, AI technologies, algorithms, predictive analyses & marketing automation are reviving the art of customer retention while increasing customer knowledge via scoring, digital strategies & predictive analyses. Interesting to segment behaviours, to re-design the customer after-sales journey, to understand the impact of contact points in online & offline channels, and potentially anticipate the tendency to re-purchase. Enhanced connectivity in vehicles provides the raw data for this analytical potential, allowing details of drivers’ behaviour behind the wheel to be monitored whenever they use the vehicle.

The democratic access to data is allowing leaders in the sector to fortify their marketing & advertising investments. Using the Marketing Mix Modelling (MMM) technique allow you to measure the impact of their investments & to ensure optimised and efficient budget allocation. This involves knowing where to invest, divesting, quantifying expected ROI, defining growth targets by country, product, range, market, channel, etc. For the most mature companies, advanced statistics have made performance more transparent. Data science, combined with business expertise, is now used as a deciding factor when making strategic decisions, making it possible to construct neutral, quantified languages, leading to new collective intelligence.

Currently, it is still too early to say which strategy will pay off. The automotive sector has particularly complex production & distribution processes, so the long-term impact of new digital native entrants remains to be seen. The question of ownership will be decisive in selecting the main winners in this market. However, one of the most fundamental issues is ownership of the data (at least access to it). Article written in collaboration with Focus Magazine – BNP Paribas.

—

> Subscribe to the data science & AI newsletter!